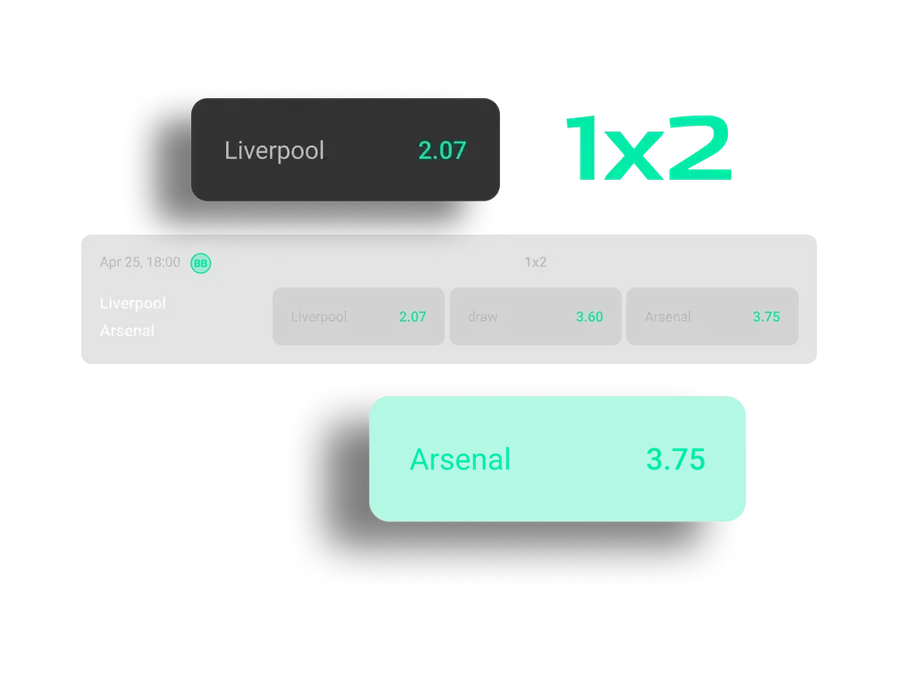

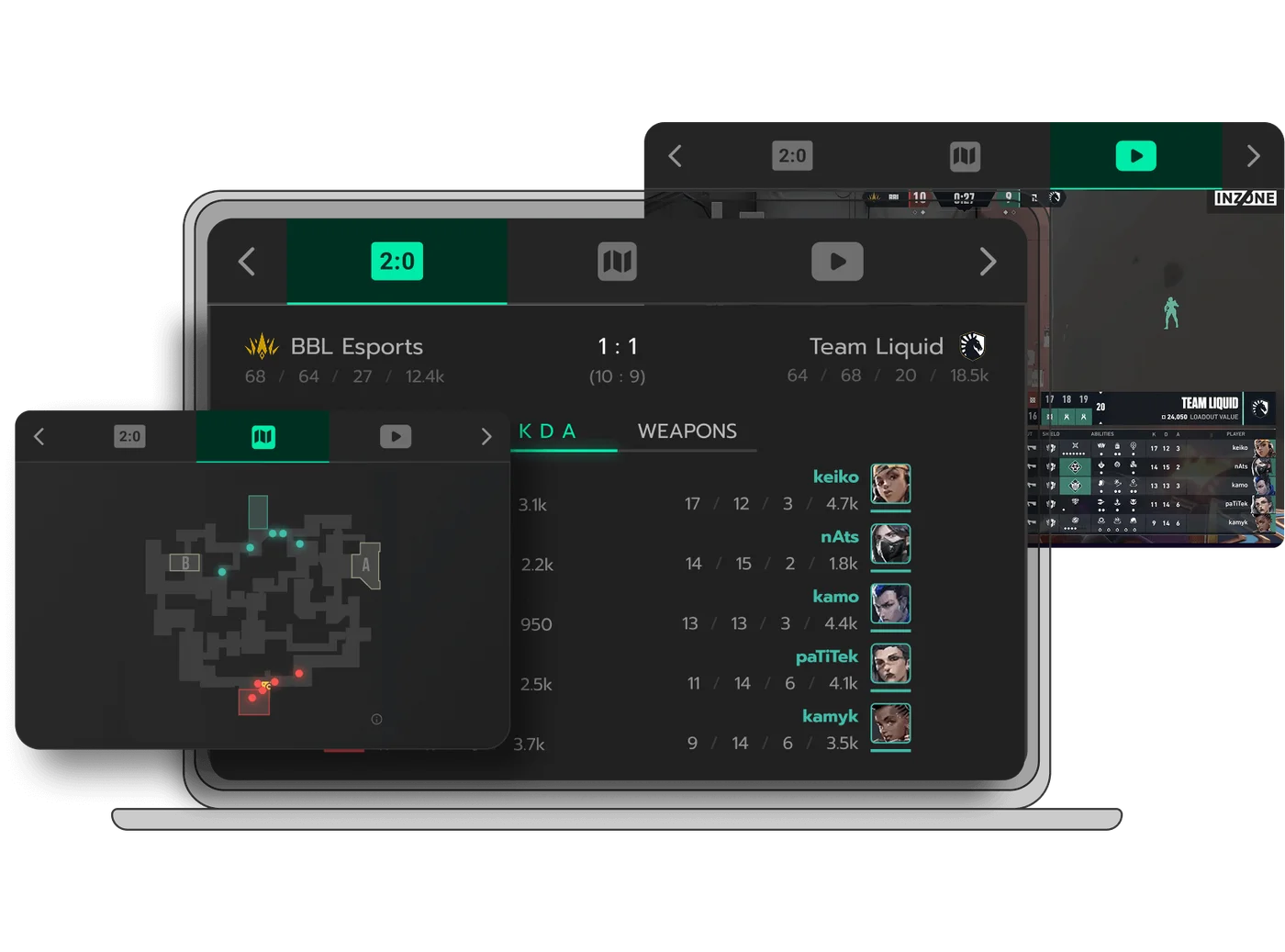

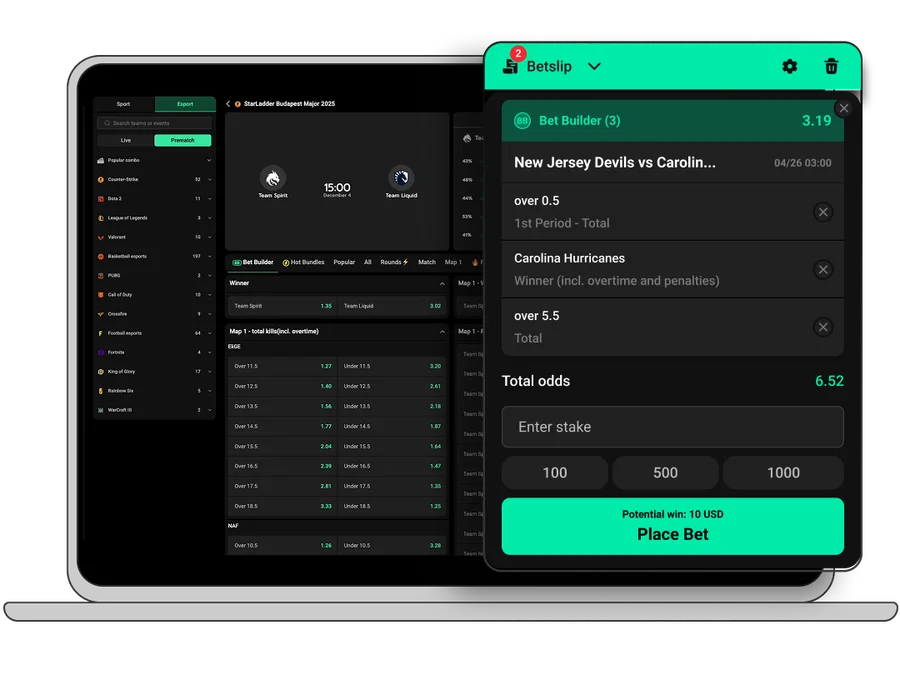

SPORTSBOOK SOLUTION: BETTING THAT WORKS

We drive results for partners with the widest coverage of sports, esports and virtual sports - powered by advanced tech, real-time risk management, licensed content and a tandem of AI-driven automation with the expertise of our team.

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

-1 (1)-1920x1440.webp?v=2026-02-12T17%3A41%3A00.052Z)

-1920x1080.webp?v=2026-02-12T17%3A43%3A04.334Z)